is car loan interest tax deductible 2019

If you use the vehicle in a business then it could be deductible. You can deduct interest on the money you borrow to buy a motor vehicle zero-emission vehicle passenger vehicle or a zero-emission passenger vehicle you use to earn business.

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

No one can only claim a deduction us 80EEB on the interest payment of the loan.

. Types of interest not deductible include personal interest such as. Interest on car loans may be deductible if you use the car to help you earn income. Here are a few of the most common tax write-offs that you can deduct from your taxable income in 2019.

May 31 2019 1138 PM. Unfortunately car loan interest isnt deductible for all taxpayers. Is Auto Loan Interest Deductible.

Can you deduct car loan interest when filing taxes. This is why you need to list your vehicle as a business expense if you wish to deduct the interest youre. View solution in original post.

If you use your car for business purposes you may be allowed to partially deduct car loan. It is fairly clear that the interest paid on home loan is allowed as a deduction in all cases. June 6 2019 1046 AM.

You can write off a. But there is one exception to this rule. No interest on a personal car is not tax deductible.

Unfortunately car loan interest isnt. Payments towards car loan interest dont count as a deduction unless the car being used is for business purposes. Interest on a car loan is considered personal and is not deductible.

Business owners and self-employed individuals. Personal credit card interest auto loan interest and other types. Should you use your car for work and youre an employee you cant write off.

When car loan interest is deductible. If youre a homeowner. An individual can claim a.

Interest paid on a loan to purchase a car for personal use. Typically deducting car loan interest is not allowed. For regular taxpayers deducting car loan interest is not allowed.

The same is true if you take out the loan to purchase stock or another investment vehicle. Credit card and installment interest incurred for. Interest on car loans may be deductible if you use the car to help you earn income.

However it is possible for taxpayers who meet certain criteria. Only if the car is used for business the business portion of interest can be. An individual can claim a.

Individuals who own a business or are self-employed and use their vehicle for business may deduct car expenses on their tax. For how many years can I claim a deduction under section 80EEB. Experts agree that auto loan interest charges arent inherently deductible.

Any interest you earn on that money while you wait is taxable. However the interest paid on car loan is not allowed as an expense in all cases. Interest on loans is deductible under CRA-approved allowable motor vehicle.

For 2020 the rate is 575 cents per mile. The loan itself isnt. Experts agree that auto loan interest charges arent inherently deductible.

Tax Deductions Lower Taxes And Tax Liability Higher Refund

Is Buying A Car Tax Deductible In 2022

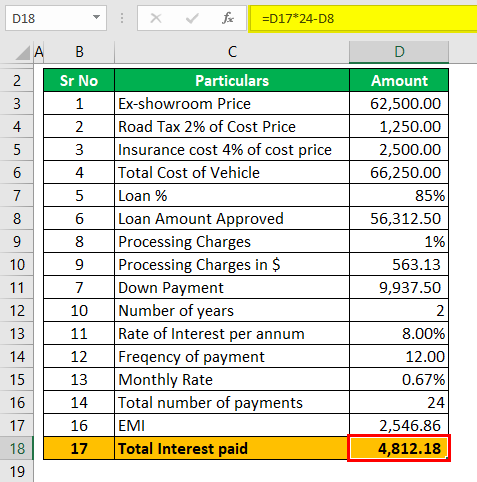

Auto Loan Calculator Calculate Auto Loan Monthly Installment

How To Claim Your New Car As Tax Deductible Yourmechanic Advice

Is Buying A Car Tax Deductible In 2022

Deducting Car Loan Interest H R Block

Is Car Loan Interest Tax Deductible Lantern By Sofi

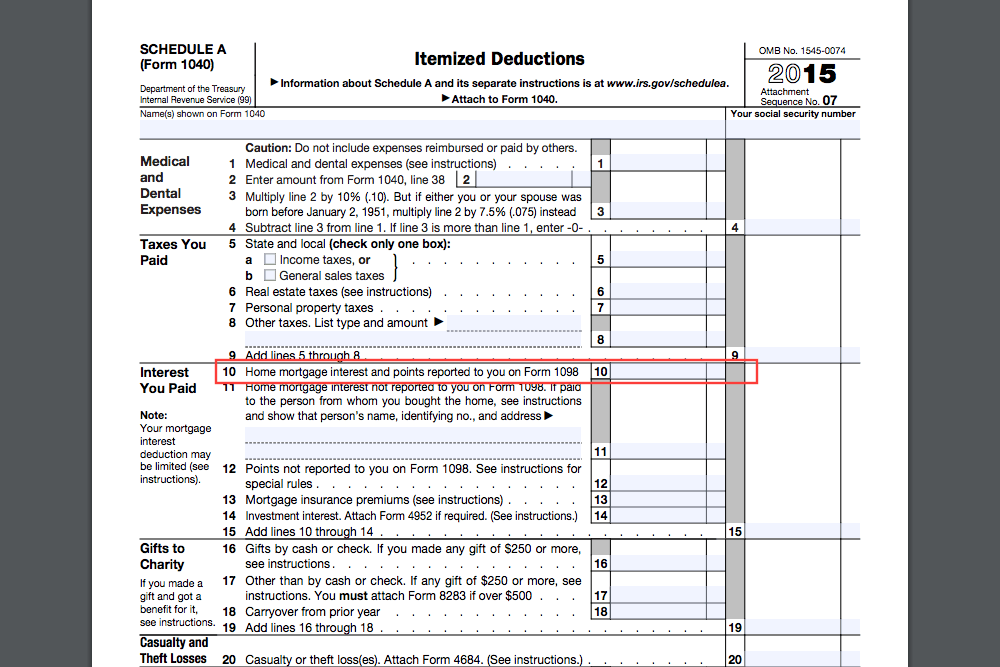

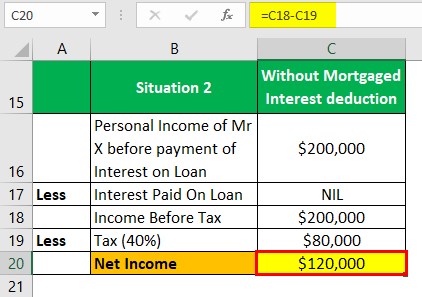

Mortgage Interest Deduction How It Calculate Tax Savings

Can The Student Loan Interest Deduction Help You Citizens

Is A Car Loan Interest Tax Deductible Mileiq

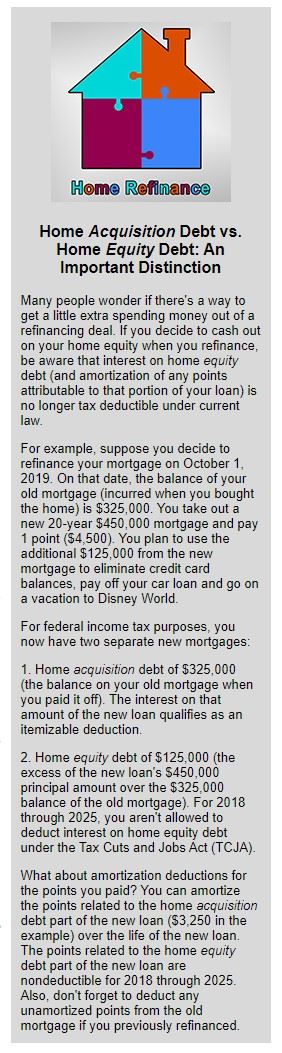

Tax Implications Of Refinancing Your Home

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

Tax Form 1098 E How To Write Off Your Student Loan Interest Student Loan Hero

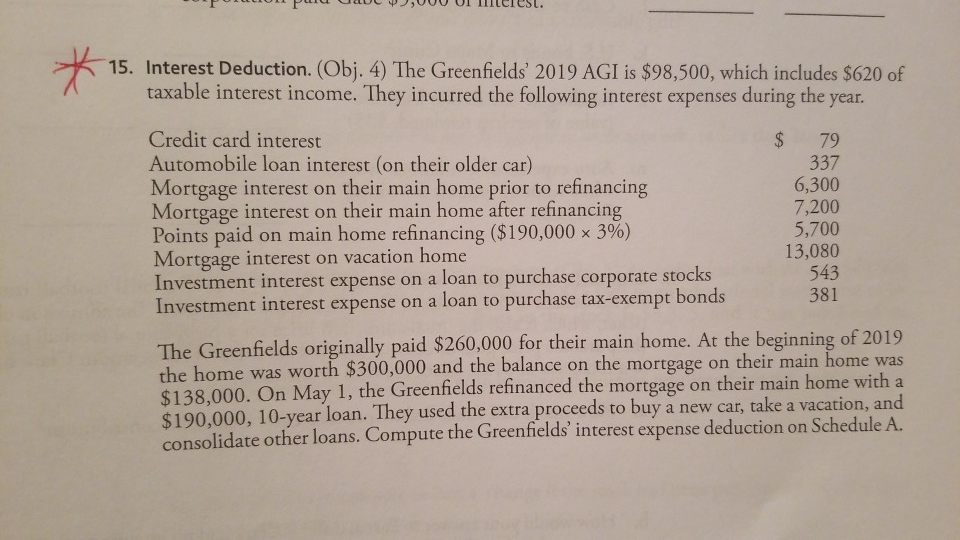

Solved Juu Uuu Ui Tulci Sl 15 Interest Deduction Obj 4 Chegg Com

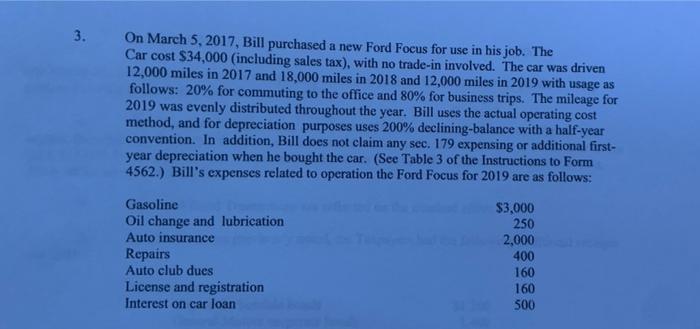

What Is His Deduction For Each Year And What Goes On Chegg Com

Five Types Of Interest Expense Three Sets Of New Rules

_(1).jpg)

Deduct The Sales Tax Paid On A New Car Turbotax Tax Tips Videos

Driving Down Taxes Auto Related Tax Deductions Turbotax Tax Tips Videos